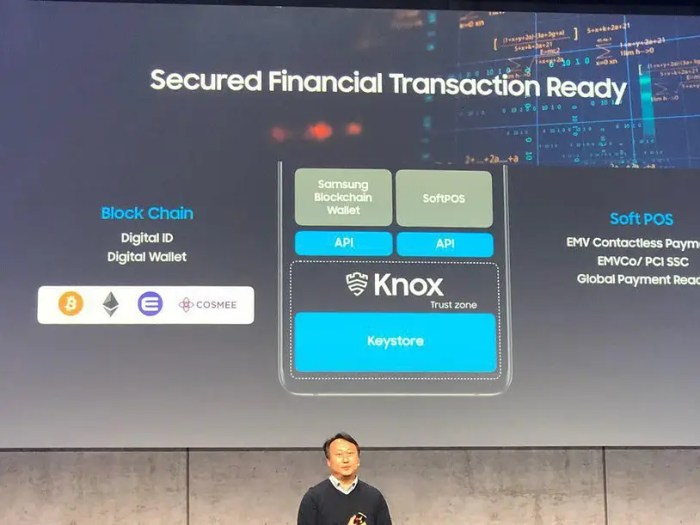

Samsung Galaxy S10 cryptocurrency wallet: The sleek S10, once a flagship phone, offered intriguing possibilities for crypto enthusiasts. But how did its hardware stack up against the competition? Could its security features truly safeguard your digital assets? This deep dive explores the S10’s capabilities as a crypto haven, examining its strengths, weaknesses, and the overall user experience.

We’ll cover everything from compatible wallets and security protocols to transaction fees and the legal landscape surrounding crypto storage on the device. Prepare to unlock the secrets of managing cryptocurrency on your old (but maybe still cool) Samsung Galaxy S10.

Supported Cryptocurrency Wallets on Samsung Galaxy S10: Samsung Galaxy S10 Cryptocurrency Wallet

The Samsung Galaxy S10, while not having a built-in cryptocurrency wallet, offers excellent compatibility with various external wallets, both hardware and software-based. Choosing the right wallet depends heavily on your security needs and comfort level with technology. This section explores some popular options and their key differences.

Several factors influence the selection of a cryptocurrency wallet for your Samsung Galaxy S10. Security, user-friendliness, and the range of supported cryptocurrencies are all critical considerations. Hardware wallets, generally considered more secure, offer a higher level of protection against theft or hacking, while software wallets often prioritize ease of use and accessibility.

Popular Cryptocurrency Wallets Compatible with Samsung Galaxy S10

Many wallets function seamlessly with the Samsung Galaxy S10 through its mobile operating system. Below is a comparison of some popular choices, keeping in mind that the cryptocurrency landscape is constantly evolving, and wallet availability might change.

| Wallet Name | Supported Cryptocurrencies | Security Measures | User Interface |

|---|---|---|---|

| Trust Wallet | Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB), and many others; supports thousands of tokens. | Multi-signature support, biometric authentication (fingerprint, face ID), regular security updates. | Intuitive and user-friendly, with a clean interface. |

| Exodus | Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and a selection of other popular cryptocurrencies. | Multi-signature support, strong encryption, regular security audits. | Visually appealing and easy to navigate, even for beginners. |

| Coinbase Wallet | Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and many ERC-20 tokens. | Biometric authentication, two-factor authentication (2FA), secure storage practices. | User-friendly design, with features like easy sending and receiving. |

| Ledger Live (with Ledger Nano S/X) | Supports a wide range of cryptocurrencies, depending on the app integration. | Hardware-based security, offline storage of private keys, strong physical protection. | User-friendly interface for managing your hardware wallet. |

Security Protocols: Hardware vs. Software Wallets, Samsung galaxy s10 cryptocurrency wallet

The fundamental difference between hardware and software wallets lies in where your private keys are stored. Software wallets, like Trust Wallet or Coinbase Wallet, store your keys on your phone’s operating system. While often convenient, this makes them vulnerable to malware or phone theft. Hardware wallets, such as the Ledger Nano S/X, store your keys on a secure, physical device separate from your phone. This offline storage significantly reduces the risk of hacking or unauthorized access.

Hardware wallets generally employ advanced security features including tamper-evident packaging, secure elements, and physically protected chips to ensure your private keys remain safe. Software wallets rely heavily on strong encryption and security updates to protect your assets. However, a compromised phone could compromise the security of your software wallet, while a stolen or damaged hardware wallet can be replaced, and its keys remain safe, provided you have your recovery phrase.

Security Considerations for Storing Crypto on a Samsung Galaxy S10

Storing cryptocurrency on your Samsung Galaxy S10 offers convenience, but it’s crucial to understand the inherent risks. The mobile nature of your phone exposes it to threats that a desktop wallet might avoid. Let’s delve into the potential dangers and how to mitigate them. Remember, your crypto’s security is your responsibility.

The Samsung Galaxy S10, while a powerful device, isn’t immune to the various threats targeting cryptocurrency holders. Malware can steal your private keys, phishing scams can trick you into revealing sensitive information, and physical theft can result in the loss of your entire portfolio. The convenience of mobile access comes at the cost of increased vulnerability. Therefore, robust security measures are absolutely paramount.

Risks Associated with Storing Crypto on a Samsung Galaxy S10

Several significant risks are associated with storing cryptocurrency on a mobile device like the Samsung Galaxy S10. These risks demand careful consideration and proactive mitigation strategies.

- Malware: Malicious software can infect your phone and steal your private keys, granting access to your cryptocurrency. This can happen through infected apps, websites, or phishing emails.

- Phishing: Phishing attacks often mimic legitimate cryptocurrency platforms or services, tricking users into revealing their login credentials or private keys. These attacks can be highly sophisticated and difficult to detect.

- Physical Theft: If your phone is stolen, the thief could potentially access your cryptocurrency if you haven’t implemented strong security measures. This risk is amplified if you’re using a simple passcode or no biometric security.

Best Practices for Securing a Samsung Galaxy S10 Used for Cryptocurrency Storage

Implementing these best practices significantly reduces the risk of losing your cryptocurrency stored on your Samsung Galaxy S10. These steps are not optional; they’re essential for protecting your digital assets.

- Strong Passcode/Biometrics: Use a strong, unique passcode (at least 6 digits, ideally longer and alphanumeric) or enable biometric authentication (fingerprint or facial recognition) for enhanced security. Avoid easily guessable passcodes.

- Regular Software Updates: Keep your Samsung Galaxy S10’s operating system and all apps updated to the latest versions. Updates often include security patches that address known vulnerabilities.

- Install Reputable Security Software: Use a reputable antivirus and anti-malware application to scan your phone regularly and protect against malicious software.

- Use a Hardware Wallet (If Possible): For larger cryptocurrency holdings, consider using a hardware wallet, a physical device specifically designed for secure cryptocurrency storage. While not directly integrated with the phone, it provides an extra layer of security.

- Enable Two-Factor Authentication (2FA): Whenever possible, enable 2FA for all cryptocurrency exchanges and wallets you use. This adds an extra layer of security, requiring a second verification step beyond your password.

- Be Wary of Suspicious Links and Emails: Never click on suspicious links or open emails from unknown senders. Phishing attacks often use deceptive tactics to trick users into revealing sensitive information.

- Regularly Back Up Your Wallet Data (Securely): Back up your wallet’s recovery phrase, but store it securely offline – perhaps in a physical safe or a well-hidden, encrypted document. Never store it digitally on your phone.

Setting Up a Secure Wallet on the Samsung Galaxy S10

Setting up a secure wallet involves several crucial steps. Follow these instructions carefully to minimize the risks.

- Choose a Reputable Wallet: Select a well-established and reputable cryptocurrency wallet app from the Galaxy Store or Google Play Store. Read reviews and ensure the app has a strong security track record.

- Download and Install: Download and install the chosen wallet app. Be cautious of unofficial sources or apps that seem too good to be true.

- Create a New Wallet: Follow the app’s instructions to create a new wallet. Carefully note down your recovery phrase (seed phrase). This phrase is crucial for restoring your wallet if you lose access to your device.

- Secure Your Wallet: Set a strong passcode or enable biometric authentication for your wallet. Follow the app’s security recommendations.

- Transfer Cryptocurrency: Transfer your cryptocurrency to your newly created wallet. Double-check the receiving address before initiating the transfer.

- Regularly Monitor Your Wallet: Keep an eye on your wallet’s activity and check for any suspicious transactions.

Transaction Process and Fees on Samsung Galaxy S10

Sending and receiving cryptocurrencies on your Samsung Galaxy S10 is surprisingly straightforward, though the exact process varies slightly depending on the specific cryptocurrency wallet app you’re using. Generally, the process involves selecting the cryptocurrency you want to send, entering the recipient’s wallet address, specifying the amount, and confirming the transaction. Security features like biometric authentication (fingerprint or facial recognition) add an extra layer of protection. However, understanding the associated fees and transaction speeds is crucial for a smooth experience.

The transaction process itself usually involves a few simple steps within the chosen wallet app. First, you select the cryptocurrency you wish to send. Next, you’ll need the recipient’s public wallet address – this is essentially their digital bank account number for crypto. After inputting the address and the desired amount, the app will calculate the transaction fee. Finally, you authorize the transaction, often through a biometric scan or a PIN code. The transaction is then broadcast to the relevant blockchain network for processing.

Transaction Fees on Samsung Galaxy S10 Wallets

Transaction fees vary significantly depending on several factors, including the cryptocurrency itself, network congestion (how busy the blockchain is), and the specific wallet app’s fee structure. Some wallets might charge a flat fee per transaction, while others might use a percentage-based model. For example, a transaction involving Bitcoin might incur a higher fee during periods of high network activity, whereas a transaction with a less popular cryptocurrency might be cheaper. Furthermore, some wallets might incorporate additional fees for things like expedited transactions or premium customer support. It’s essential to carefully review the fee structure of your chosen wallet before initiating any transactions to avoid unexpected costs. Checking the fee estimate provided by the wallet *before* confirming the transaction is a crucial step.

Transaction Speed Comparison

Transaction speeds on the Samsung Galaxy S10, like any other platform, are largely determined by the blockchain network’s processing capabilities. For instance, Bitcoin transactions can take anywhere from a few minutes to several hours to confirm, while faster cryptocurrencies like Litecoin or Ripple often provide much quicker confirmation times. Compared to centralized exchanges, which generally offer near-instantaneous transactions, blockchain-based transactions on the S10 might seem slower. However, this difference stems from the fundamental nature of decentralized cryptocurrencies: the security and transparency of the blockchain network come at the cost of speed. Using a wallet on your S10 offers the benefit of self-custody of your assets, a trade-off often considered worth the slightly longer transaction times. Consider the security benefits of a self-custodial wallet when weighing the speed versus convenience of centralized exchanges.

Regulatory Compliance and Legal Aspects

Using cryptocurrency wallets on your Samsung Galaxy S10, while offering convenience and accessibility, necessitates understanding the legal framework surrounding digital assets in your region. The regulatory landscape for cryptocurrencies is rapidly evolving and varies significantly across jurisdictions, impacting everything from tax implications to the legality of holding and transacting with cryptocurrencies. Ignoring these legal aspects can lead to serious consequences.

The use of cryptocurrency wallets on a Samsung Galaxy S10 is subject to the laws of the jurisdiction where the user resides and operates. Regulations differ widely, ranging from outright bans to comprehensive regulatory frameworks. Understanding these differences is crucial for responsible and compliant cryptocurrency use. Failure to comply with relevant regulations can result in penalties, including fines and even criminal prosecution.

Cryptocurrency Regulations by Region

The following table provides a simplified overview of the regulatory landscape for cryptocurrencies in select regions. Note that this information is for general understanding and should not be considered legal advice. Always consult with legal professionals for specific guidance regarding your jurisdiction.

| Region | Regulatory Status | Key Considerations | Examples |

|---|---|---|---|

| United States | Complex and evolving, with varying state-level regulations. Federal agencies like the SEC and FinCEN play significant roles. | Tax implications, anti-money laundering (AML) and know-your-customer (KYC) requirements, state-specific licensing for exchanges. | Different states have different approaches to crypto taxation, and federal regulations are constantly being updated to address issues like stablecoins and decentralized finance (DeFi). |

| European Union | The EU is working towards a comprehensive regulatory framework (MiCA) to govern crypto assets. Individual member states also have their own regulations. | Compliance with MiCA (once enacted), anti-money laundering (AML) and know-your-customer (KYC) requirements, data protection regulations (GDPR). | MiCA aims to create a unified regulatory space for crypto assets within the EU, addressing issues like market abuse and consumer protection. However, individual member states still maintain some level of regulatory control. |

| Singapore | Relatively progressive and supportive, with a focus on innovation and responsible development. | Licensing requirements for cryptocurrency exchanges and service providers, anti-money laundering (AML) and know-your-customer (KYC) requirements. | Singapore has a framework that encourages innovation while mitigating risks associated with cryptocurrencies. However, regulations are still evolving and require ongoing monitoring. |

| China | Generally restrictive, with bans on cryptocurrency trading and mining. | Strict prohibitions on cryptocurrency-related activities, potential penalties for non-compliance. | China has implemented a near-total ban on cryptocurrency trading and mining, making it extremely difficult to use cryptocurrencies within the country. |

Tax Implications of Cryptocurrency Transactions

Tax laws regarding cryptocurrency transactions vary considerably by jurisdiction. In many countries, cryptocurrency transactions are treated as taxable events, similar to trading stocks or other assets. Capital gains taxes may apply to profits from cryptocurrency trading, and losses may be deductible. It’s crucial to understand your local tax laws and accurately report your cryptocurrency transactions to avoid penalties. Failure to do so can result in significant financial liabilities. For example, in the US, the IRS considers cryptocurrency as property, meaning profits are taxable events.

Ultimately, the Samsung Galaxy S10’s suitability as a cryptocurrency wallet depends on individual needs and risk tolerance. While its hardware offered a decent foundation, security remains paramount. Understanding the inherent risks, employing best practices, and choosing the right wallet are crucial for a positive crypto experience. Remember, the responsibility for securing your digital assets rests solely with you. So choose wisely, and stay vigilant!

Blockchain Essentials Berita Teknologi Terbaru

Blockchain Essentials Berita Teknologi Terbaru